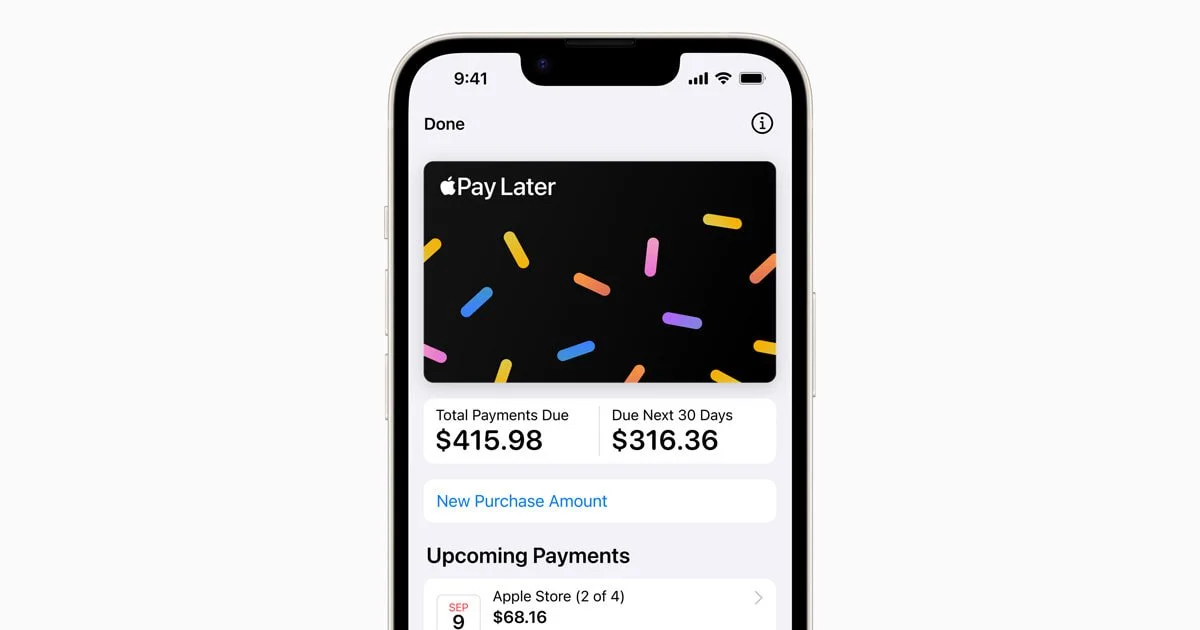

Purchases can be split into four payments with no interest or fees.

We’ve all been there. We’ve been waiting for pay day, and the ping of our salary into our account. Well, Apple has launched something to make that time of the month a little easier, Apple Pay Later. The new feature is currently only available in the United States, but is expected to roll out across the world.

The new feature allows users to split their purchases into four payments – best of all, it includes zero interest and no fees. Users can apply for a loan within the Wallet, and it will not impact to their credit.

Users must enter the amount they would like to borrow, and agree to the terms and conditions. The process includes a soft credit search, which ensures that users can take out the loan.

Apple Pay Later is designed in that user-friendly Apple way. All purchases are authenticated using Face ID, Touch ID or passcode. The option is built into the Wallet, so users can view, track and manage the loans. Before a payment is due, users will receive a notifications and email.

Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet, explained: “There’s no one-size-fits-all approach when it comes to how people manage their finances. Many people are looking for flexible payment options, which is why we’re excited to provide our users with Apple Pay Later.

“Apple Pay Later was designed with our users’ financial health in mind, so it has no fees and no interest, and can be used and managed within Wallet, making it easier for consumers to make informed and responsible borrowing decisions.”

Would you use Apple Pay Later?

GO: Visit www.apple.com for more information.